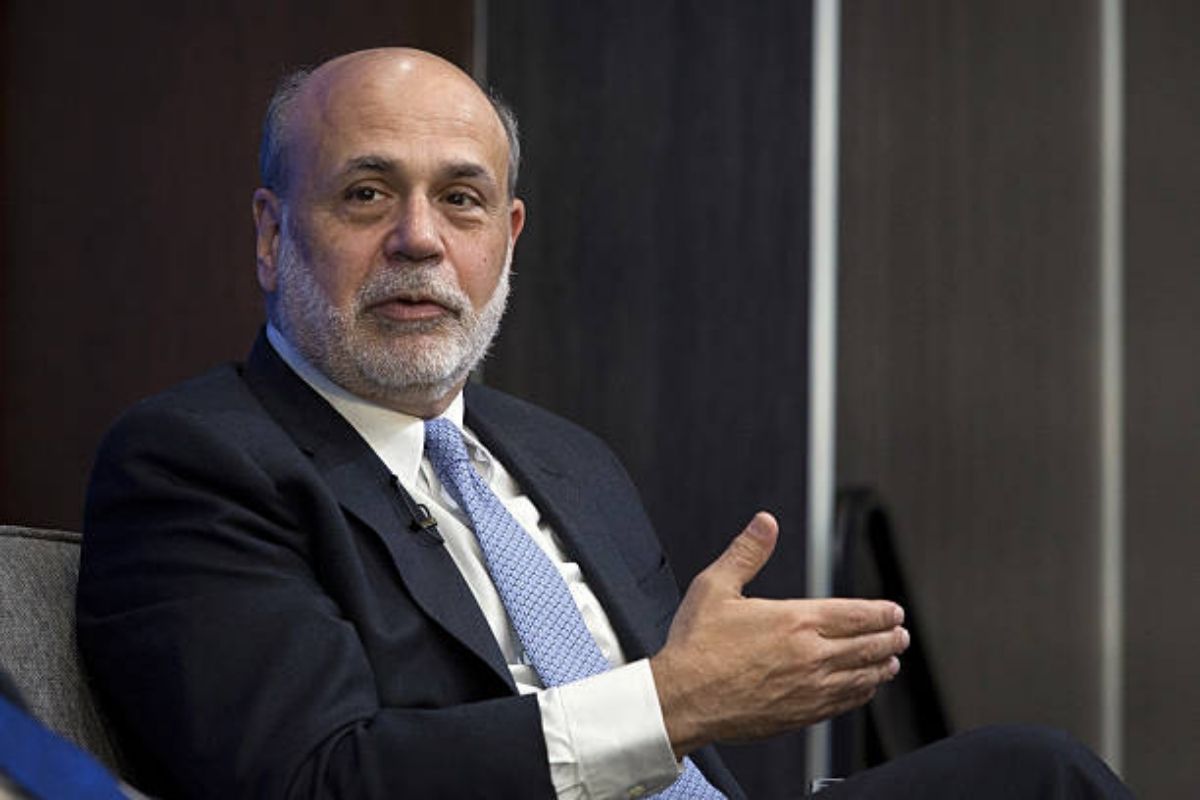

The Fed’s Slow Response to Inflation was a Mistake, Says Ex-Chair Ben Bernanke

Federal Reserve Chairman Ben Bernanke has criticized the central bank for delaying action on an inflation problem that has evolved into the greatest financial crisis since the early 1980s.

The Federal Reserve’s current leadership has been chastised by the banker who led the US through the Great Recession for moving too slowly to rein in inflation.

Fed’s Slow Response to Inflation was a Mistake According to Ben Bernake

According to the former Fed chair, the Fed’s tardy response would lead to weak economic growth, an increase in unemployment, and rising inflation over the next year or two.

Must read-

- Hank Williams jr Net Worth In( 2022), Career And More INFO

- New Nintendo Console Release Date Confirmed for 2024 (Latest News)

He also cautioned that a poor economic performance would be the result of such a sluggish response.

Bernanke told the New York Times that “even under the benign scenario, we should have a slowing economy.”

Ex-chairs Alan Greenspan and Janet Yellen have seemed to go out of their way to avoid being criticized by their successors. Bernanke’s remarks were an exception, though carefully worded to avoid being too harsh.

Prior to the release of his new book, 21st Century Monetary Policy, Federal Reserve Chairman Ben Bernanke spoke to the media.

“And inflation’s still too high, but coming down. So there should be a period in the next year or two where growth is low, unemployment is at least up a little bit and inflation is still high,” he predicted. “So you could call that stagflation.”

During the financial crisis of 2008, Bernanke was in charge of the Federal Reserve and presided over unprecedented monetary policy expansion. He told CNBC that the subject of when action should have been done to tamp down inflation is “complicated.”

At the same time, Elon Musk declared that the US economy was “probably” in a recession and warned businesses to control expenses and cash flows, a statement that was at variance with experts’ assessments and the evidence that was available.

According to a Twitter user’s live-streamed footage of Musk’s remarks at the All-In Summit in Miami Beach, “These things pass, and then there will be boom times again. I don’t know, a year, maybe 12 to 18 months,” he says. “It’s going to be a rough ride.”

“The question is why did they delay that. … Why did they delay their response? I think in retrospect, yes, it was a mistake,” he told CNBC’s Andrew Ross Sorkin in an interview that aired during Monday’s “Squawk Box” show. “And I think they agree it was a mistake.”

Jerome Powell‘s Federal Reserve has to respond aggressively to the Covid epidemic in March 2020, much like Bernanke’s central bank did in 2008. Almost all of the response was based on the financial crisis, although to a much greater extent.

Obama’s Fed chairman said the U.S. is likely in for 1970’s-style “stagflation” under Biden.

Ben Bernanke also criticized Biden student loan cancellation as “very unfair.”

Via @KarlSalzmann https://t.co/XiLZ7BWjKR

— Washington Free Beacon (@FreeBeacon) May 16, 2022

Since then, it has maintained that historically lenient monetary policy.

Now, the Federal Reserve is raising interest rates and reducing its bond holdings, starting in June. Critics say the Fed delayed too long to reduce its stimulus, and it must now contend with inflation running at an annual rate of 8.3 percent.

According to Bernanke, he understands why the Powell-led Fed sat on its heels.

“One of the reasons was that they wanted not to shock the market,” he said. “Jay Powell was on my board during the Taper Tantrum in 2013, which was a very unpleasant experience. He wanted to avoid that kind of thing by giving people as much warning as possible. And so that gradualism was one of several reasons why the Fed didn’t respond more quickly to the inflationary pressure in the middle of 2021.”

Late in 2020, the Federal Reserve shifted its policy framework to signal that it would allow inflation to run higher than normal in order to ensure a full and inclusive jobs recovery.

Because of pandemic-specific factors, authorities stated that they expected inflation to be “transitory” in the spring of 2021 when it exceeded the 2 percent objective. “forward guidance” has been used by various Federal Reserve officials in recent days to defend their response to the recent rise in inflation and the subsequent rise in interest rates.

According to Bernanke, despite the analogies to hyperinflation in the late 1970s and early ’80s, the current inflation run is distinct from the last time prices rose at such a rapid pace.

The present central bank also has more credibility in fighting inflation and has greater public support for rate hikes.

Federal Reserve Chairman Ben Bernanke said there is a lot of support among financial markets for the Fed’s current policy of raising interest rates. “You know, we’ll see the effects in house prices, etc. So those are some ways in which the current situation I think is better because we learned a lot from the ’70s.”

“21st Century Monetary Policy: The Federal Reserve from the Great Inflation to COVID-19” is the title of Bernanke’s latest book, which will be released on Tuesday.

I hope you found the information presented above to be of use. You can also look through our entertainment section, where we normally cover all of the most recent TV episodes, web series, anime, and other media. Visit our website if you’d like to learn more about this topic.